TedTalk: Why do so many incompetent men become leaders?

Potential causes:

1) Ability to distinguish between

- Competence v/s Confidence

- Leadership v/s Authority

- Adaptive v/s Technical Work

A possible remedial measure:

TedTalk: Why do so many incompetent men become leaders?

1) Ability to distinguish between

A possible remedial measure:

“Eventually, all things merge into one, and a river runs through it.”

– Norman McLean

Reference:

Youtube Channel: Ianapolis

Waterfall scene

”Sail away from the safe harbor, catch the trade winds in your sails!

Explore. Dream. Discover”

-Mark Twain

Reference:

Youtube Channel: Ianapolis

Jetty Sunset

Mohabbat Hai Isiliye Toh Jane Diya, Zid Hoti to Bahon Me Hoti!

Reference:

Youtube: Couple in the Twilight by Homemade Illustration

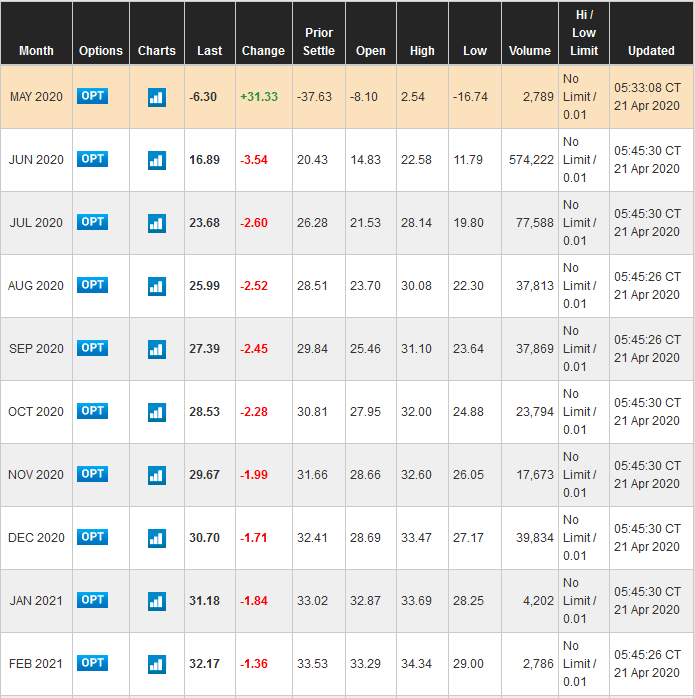

The Indian Oil Contracts trading on MCX is settled according to the New York Mercantile Exchange’s (NYMEX) Crude Oil (CL) front-month contract on the last trading day of the MCX Crude Oil contract.

Negative prices exist in the commodity futures market. These are an indicator of the fact that the opportunity cost of the shutdown, delivery of goods, and other administrative expenses are sometimes quite higher. In other words, it can also imply that you pay people to take the commodity off your hand.

It is a market condition where the future prices of a commodity are considerably higher than the current spot prices.

The price of oil made a 34-year low since 1986 on 20th April 2020. The drop-in rates can be traced down to the futures oil market. On the surface, the negative price implies that the producers would pay traders to take away the oil. The price collapse was a market anomaly that portrays how commodities are traded.

The expiry of the May Oil Contract was on 21st April. The WTI crude futures price, which entered the negative territory and made historical lows, needs to be physically delivered at Cushing on expiry. Demand has significantly slumped due to lockdowns, and there has been a steady rise in storage and transportation costs. Also, logistic constraints need to be factored in for the physical delivery of oil. It might even lead to companies claiming force majeure clauses and violation of contracts.

With no demand for oil and the existing reserves at near capacity, no one wanted the physical delivery of oil to accumulate it and pay for the storage costs.

Speculators are an integral part of the commodities markets too. Speculators usually buy and sell contracts with no intention of accepting or offering the delivery. These participatory speculators need to unwind their positions on the contract expiry day to avoid taking the physical delivery of oil. Speculators were unwinding the future contracts to close their positions or rolling over their contracts before the expiry might have led to such a drastic fall in prices.

The delivery-based traders backing out on the contract due to a fall in oil demand can also be attributed to this fall. A combination of both categories of traders in play has brought havoc in the oil future markets.

Many speculators rolling over their contracts to June and future expiry dates pushed down the short-term prices even more. The future prices of oil are higher, thereby leading to contango in the market. The higher rates in the future also indicate the market expectations of resuming economic activity in the coming future as lockdowns are lifted. We can also expect the storage space to be created as existing reserves will be used up. Contango trades by market participants will be the norm in the coming days. These trades essentially translate to traders buying oil at lower prices now and storing them and releasing it in the market in the future when both demand and prices rise.

The WTI crude price fall also has raised concerns about the liquidity crisis looming over the banks in Texas. However, the Federal Reserve has promised to back up the banks to prevent another systemic failure. The fall in prices might even lead to a deflationary scenario as the price of oil dependent products would fall, which would then raise questions on the usage of substitute cleaner sources of energy.

SEBI and MCX are closely monitoring the negative oil prices. SEBI will be leading the way in dealing with negative rates. Taking in mind the system failures which might occur due to such sudden drops in prices and the drop-in prices in NYMEX Oil from which MCX derives its rates, MCX has now over nightly fixed the settlement price of the contract at Re 1 with further finalizations to be announced.

India has been piling up the strategic reserves in Mangalore, Vishakhapatnam, and Padur, near Udupi. The storing capacity has also been increased to take advantage of the lower oil prices. The fall in oil prices would lead to the fall in the oil expense of the nation and can be seen as an unforeseen relief to the government in its fight against the pandemic. The current account deficit may also reduce if the economic recovery is quick, and we are able to build up momentum with an increase in Indian exports.

Must know financial functions in excel

For further reference:

The steps involved in creating financial spreadsheets can be summarized as follows:

For further Reference:

The list of python libraries for algorithmic trading:

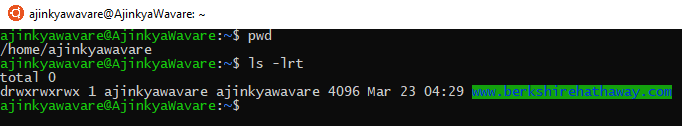

Ubuntu App can be installed in Windows from the windows store.

Different other linux flavours are also available for download here.

To access the file system of this ubuntu system from windows, the following path needs to be looked into:

%userprofile%\AppData\Local\Packages

The above directory can be accessed in windows file system location:

Summer Internship placements play an important part in shaping your MBA journey. A lot of effort is exerted to make the most of this opportunity by MBA candidates. Choosing the domain to pursue your career can be challenging in the early stages as you may not have knowledge about the entire spectrum of the domain, the nuances in it and the work you would have to do.

Preparations required for each and every domain like Consulting, Marketing, Operations, Finance, ProdMan and General Management differ a lot as the roles require different skills to excel in it. However, preparing for consulting can be a safe option as the preparations for consulting, marketing and GenMan have a certain overlap. This helps the candidates to have a backup option if they are not able to get an internship in their desired domain.

ProdMan prep can be easily accomplished by an individual pursuing his MBA. Time is a major constraint in an MBA students life, ProdMan prep would have certain overlap with other domains and would help the individual to crack case interviews. The approach followed for cracking the PM interview is same as the one required for Consult/GenMan roles. ProdMan roles typically include liaison between Business and Tech team, planning for next deliverables of the product. The role gives the PM complete autonomy in deciding the future of the product.

Shortlists for the consulting companies would be out first, followed by finance and a few prod man companies. Shortlisting criteria for the companies differ as per the roles they have to offer.

Who should prepare for ProdMan roles:

B. Tech Candidates who have prior experience in Services industry either from Dev/Business side and others with previous related work experience.

Shortlists and Hotlists:

The shortlists would come to the candidates with the above-mentioned credentials to their names. As an MBA comes with its own twist and turns, getting a shortlist doesn’t have any effect as the Big IT giants would have their preferred candidates who would be on their Hotlists. The Hotlists of candidates would come in a day before the scheduled interviews.

GD Round

ProdMan requires candidates to go through the GD rounds. For GD preparation go through the sector reports shared by the clubs in the college. This would provide you with enough factual data about different industries to be used in the GDs.General awareness is a must to crack the GDs. The candidate should go through mock GDs conducted by college clubs to get a flavour of the heat thats going to be there on the final GD day.

Don’t lose your calm. Stay focused and make it a point to speak at least 2-3 sensible points. Normal GD evaluation criteria by panellists would be done. If you are thorough with the basics, the round should be a piece of cake to crack.

Interview Round Prep

The interviewers would ask you questions to judge your thought process and logical flow of ideas to structure and find solution to a problem. The questions can be mainly categorized into two types:

The guesstimate problems for consult and gen man preparation are more than enough to crack this section of the interview. Keep the facts about the population of Metro cities, India, etc handy. This would greatly help you to reach the solution to the guesstimates.

The following books are to be referred for Prod Man interviews:

Reference Books:

The starting 13 chapters from Cracking the PM interview would provide the groundwork in understanding the roles and responsibilities of the job. The main crux starts in Chapter 14: Product Questions. Make sure you go through all the cases discussed in the book.

The important aspects to focus upon are that the solutions formed should make use of the concept of MECE.

MECE: Mutually exclusive and collectively exhaustive.

This would ensure that an entire holistic solution is presented to the interviewer.

Decode and Conquer should be the go-to book for solving and deep-diving into interview cases. The book talks about CIRCLES method. Following the method would ensure that you don’t miss into any aspects of the problem while presenting the interviewer with your solution. Ensure that there is two-way communication with the interviewer and all assumptions made by you for solving the case are in sync with the interviewer’s expectations.

CIRCLES Method

The steps of this method are:

C – Clarify. Ask questions to clarify anything that you are unsure of. Confirm your assumptions.

I – Identify the customers as personas like food lovers, cricket fans, high-speed users etc.

R — Report customer needs (use cases).

C — Cut, Through prioritization. The use cases should be ranked based on different attributes (revenue, feasibility, complexity).

L — List solutions.

E — Evaluate the tradeoffs of the solutions presented.

S — Summarize

The circles’ method would be greatly beneficial in forming a skeletal solution which can iteratively build upon.

For case solving, data samples can always be clustered using the HML method.

HML method

H – High

M – Medium

L – Low

Segregating the data into such buckets would greatly help you to form solutions to the problems faced by different categories as you would be focusing upon the minute aspects of the problems.

At the end of the case, state the final solution you would recommend, the benefits and the tradeoffs of the solution. Criticizing your answer in modest terms would take away the opportunity from the interviewer to do so as it highlights that you have critically analysed your solution and have looked through the loopholes in the solution presented by you.

The HR questions should be given equal importance, more but not less. Some companies would also be conducting psychometric tests to evaluate the candidate-job fit. Go through your resume thoroughly. Every point on the resume should be known in and out.

Prepare questions like:

1) Favourite product? Why? Features?

2) The product you dislike? Why?

3) Website XYZ, features liked/disliked? Add-on features to be incorporated?

4) Company product research (Eg. Microsoft product Suite, Amazon AWS offerings, etc)

Technology is ever-changing. Keeping in touch with the latest happenings in the field would help you acclimatize with the questions asked and incorporate the latest technological advancements in the solutions you would formulate. Follow the below blogs to stay in touch with the technology.

Blogs to follow:

Cheers to successfully cracking the PM interviews 😛

Feel free to reach out to me. Suggestions for improvements are welcomed.

Reference: