Summer Internship placements play an important part in shaping your MBA journey. A lot of effort is exerted to make the most of this opportunity by MBA candidates. Choosing the domain to pursue your career can be challenging in the early stages as you may not have knowledge about the entire spectrum of the domain, the nuances in it and the work you would have to do.

Preparations required for each and every domain like Consulting, Marketing, Operations, Finance, ProdMan and General Management differ a lot as the roles require different skills to excel in it. However, preparing for consulting can be a safe option as the preparations for consulting, marketing and GenMan have a certain overlap. This helps the candidates to have a backup option if they are not able to get an internship in their desired domain. Finance prep has inherent risk as the preparation required for the role is quite vast and is an entirely disjoint set to other domain preparation.

Time is a major constraint in an MBA students life, Fin prep itself would occupy your major time that you would hardly be left with any time to prepare for other domain. So, choose the Finance domain wisely. Finance roles typically include Investment Banking, Corporate Banking, Risk, Markets, Quants and niche roles in PE-VC segment.

Shortlists for the consulting companies would be out first, followed by finance and a few prod man companies. Shortlisting criteria for the companies differ as per the roles they have to offer.

Who should prepare for Finance roles:

CA, B. Tech Candidates who have prior experience in the Fin domain( FinTech, Trading, Risk) with enough certifications like CFA, CS, IAI or NCFM/NISM certifications to show their genuine interest in the field and B.Com.( Eco/ Stats)

Shortlists and Hotlists:

The shortlists would come to the candidates with the above-mentioned credentials to their names. As an MBA comes with its own twist and turns, getting a shortlist doesn’t have any effect as the Big Banks would have their preferred candidates who would be on their Hotlists. Evaluate your profile thoroughly and see if make the cut or prepare to face disappointment on the D-Day.

If you make the above cut, let’s get to the internship preparation:

Finance has been a wide domain in itself, it can be divided into different parts:

- Fundamentals

- Valuation Techniques

- Financial Instruments

- Economics

- Macroeconomics

- Microeconomics

- Mergers and Acquisitions

- PE-VC

Let’s get into the details of each segment:

- Fundamentals:

Basic Accounting course in Sem 1 plays an important part here. Understanding the three financial statements of companies can help the individual to ace this part. The typical questions asked from this part would be to highlight the importance of Balance sheet, Income-statement and Cash-flow statement and to show the relationship between them. How changing entries in one or the other sheet affect the other sheets.

The to be asked question for every candidate would be on Depreciation.

What is depreciation? –>> Remember it is a non-cash expense. Doesn’t have any impact on the Cash flow statement.

Questions around this would be asked for sure!!

- Valuation Techniques:

The four most commonly used valuation techniques are:

a) DCF

DCF can be calculated using APV and WACC. Study the CAPM model. Understand the Terminal Year Value, FCF to the firm, different formulae to calculate the FCF like from EBIT, EBITDA or CF statement, FCFE, implications of levered v/s unleveraged Beta. The relation between asset beta and equity beta.

Common questions would be the CAPM model, levering and unleveraging beta and using it for calculating DCF.Also, study the Gordon growth model, basic assumptions of the model and the DDM model.

Another topic would be P/E and trailing P/E and the difference between these.One, of the questions asked, was can beta value be negative, if yes can you illustrate an example.

Yes, the beta value can be negative and Gold is a good example of it.

b) Comparable transactions method

This is more useful in comparing M&A valuations. The synergies between the firms can be treated as an intangible asset. This provides with a more realistic and current market evaluation of the firm if the M&A would happen as it would be taking into consideration the recent M&A’s which have happened in the field.c) Multiples method

The multiples method is comparing the basic fundamental ratios of the company to the industry as well as the firms of similar market cap in the given industry. The ratio’s to look for are P/E, P/B, interest coverage ratios, solvency ratios and liquidity ratios.

An important concept that gets tested here is the Enterprise Value of the firm. Be thorough with the concept of EV. The calculation of EV and it’s implications on the market value of the firm. The famous EV/EBITDA ratio would get tested herein.

The most frequently asked question would be framed on the lines of:

“There is a firm that you want to evaluate and don’t have any sheets of the company but know the enterprise value as well as the EBITDA of the firm. Industry knowledge is readily available. How would you evaluate the firm?”

Even if some aspects of the question are not asked, the interviewer would be expecting you to ask these and reach to the final EV/EBITDA ratio of the firm and get a gross estimate of the firm based on these multiples.

d) Market Valuation

This would be directly proportional to the cmp of the listed company * the outstanding shares of the company. However, twisted questions around the value of unlisted company might be asked. A typical example would be, Do unlisted companies have their shares??

- Financial Instruments

a) StocksDifferent types of shareholding patterns in the company. The common equity stocks, preferred stock and the DVR’s. The rights and liabilities associated with it.DVR’s example would be Tata Motors DVR listed on the Indian Exchanges.

Stock splits, buybacks, dividends and its impact on the stock price.

Working hours of the markets, trading algorithms that you are aware of.

VWAP, TWAP, Stop-loss orders, etc

Some Technical analysis knowledge can come in handy. The candlestick patterns, RSI oscillator, Willian %R, SMA and EMA’s, etc.b) Bonds and Interest Rates

Understand the basics of the bonds, at par, discount and premium valuation of bonds, fed rates and reserve requirements. The impact of inflation and interest rates on the prices of the bonds should be studied in detail. As a rule of thumb, interest rates have to be greater than inflation and as interest rates rise, the prices of bonds fall. Understand the relation between economic events like unemployment figures, the dollar weakening against yen, stock market drops and healthy earnings report by companies.

Other topics to look into would be FRA’s, bond duration, modified duration Macaulay duration, convexity and inverted yield curves.

c) Currency

Spot and Forward rate, CME(Capital markets equilibrium), Pegged vs Floating rates, currency appreciation vs depreciation and currency revaluation vs devaluation must be studied.

Interest and inflation rates directly impact currency values. If inflation rises, the currency value will decrease and vice versa. Similarly, if the interest rate rises in the country, the currency will strengthen and vice versa. A must-read in this section is to know about the Asian Currency crisis,1997

d) Options, Futures and Swaps

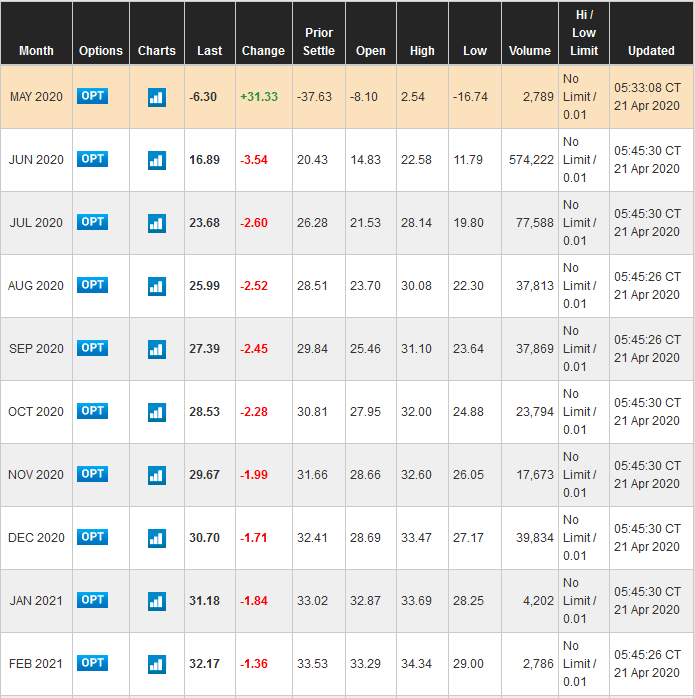

Understand the difference between Forwards and Futures, premium, different factors like stock price, exercise price, volatility, time to expiration, interest rates and dividends and their impact on option prices, Options put v/s call and going long on an option v/s writing an option. The different strategies like bull call/put, bear call/put, long/short straddle, long/short strangle, butterfly, synthetic long and arbitrage opportunities in it.

If time permits, the Black-Scholes-Merton model of Option pricing should be studied upon by the candidates.

Know the market circuit rules for stocks and their impact on the option prices. One typical question asked in this section was, If a stock has a lower circuit on it, what will happen to the prices of the futures market?

Swaps are an interesting topic to be tested in the interviews. The interest rate and currency swaps are generally well known by the candidates. However, know about the Equity swap and custom swaps in the market. Illustration of the same would be S&P 500 swap between two parties. The questions that would follow would be what happens to the cash flows and how is dividend given by the company accounted for in the swap.

One of the challenging question encountered in this segment would be to design different financial products using futures and options.

Eg: Design an equity swap on a single stock making use of option strategies.

The payoff matrix for each option instrument must be thoroughly understood and then the final product should be designed. The payoffs received in either of the cases should be same.

- EconomicsKnow about the recent happenings in the country and the important events around the world. The Fed rates and RBI meetings are the events to watch for. Know the current Repo rate, reverse repo rate, SLR, CRR and MCLR rates.

Know about the financial crisis of the 1930s, 1980s and 2007; the causes and the effects of it. NBFC crisis in India, economic slowdown, Oil prices from OPEC, negative interest rates in Japan and European countries, the Greek crisis, Venezuela crisis and Turkish currency crisis.Financial Crisis

- Mergers and Acquisitions/ PE-VC

Topics to cover include Stock swaps, cash offers, goodwill accounting, Accretive v/s Dilutive mergers. Also, learn about the different types of valuation methods in details if the candidate is preparing for niche PE-VC role. - Miscellaneous

Guesstimates play an important part as they might be asked as an ice-breaker or to relieve stress in the middle of an interview. The candidate should also prepare one industry in detail. The in and outs like the profit margins, Porter 5 forces, PESTEL analysis, CAGR and size of the industry should be known. The candidate should also prepare one stock to pitch from this industry. The ratio analysis should come in handy. The candidate should have his/her own opinion on the position to take on the stock. Also, generic questions like what is your opinion about the current markets/economy should be prepared by the candidate.

Also, keep in touch with the latest economic happenings:

Follow Mint, Finshots and Finimize for concise daily summaries.

Feel free to reach out to me. Suggestions for improvements are welcomed.