Laying the foundation

Benchmarks of crude oil

- WTI (West Texas Intermediate)

- Brent Blend Crude

- OPEC+ reference basket

The Indian Oil Contracts trading on MCX is settled according to the New York Mercantile Exchange’s (NYMEX) Crude Oil (CL) front-month contract on the last trading day of the MCX Crude Oil contract.

Negative Prices in Commodity Market

Negative prices exist in the commodity futures market. These are an indicator of the fact that the opportunity cost of the shutdown, delivery of goods, and other administrative expenses are sometimes quite higher. In other words, it can also imply that you pay people to take the commodity off your hand.

Contango

It is a market condition where the future prices of a commodity are considerably higher than the current spot prices.

The Story so far…

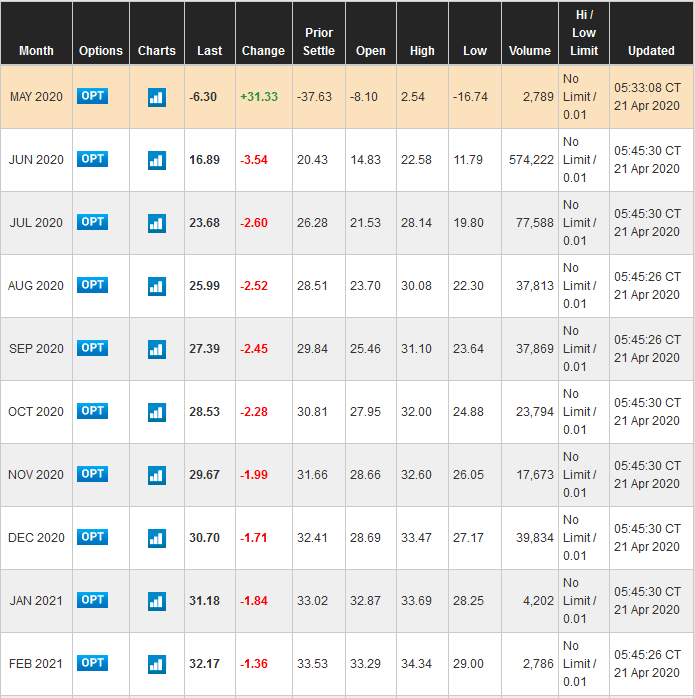

The price of oil made a 34-year low since 1986 on 20th April 2020. The drop-in rates can be traced down to the futures oil market. On the surface, the negative price implies that the producers would pay traders to take away the oil. The price collapse was a market anomaly that portrays how commodities are traded.

The expiry of the May Oil Contract was on 21st April. The WTI crude futures price, which entered the negative territory and made historical lows, needs to be physically delivered at Cushing on expiry. Demand has significantly slumped due to lockdowns, and there has been a steady rise in storage and transportation costs. Also, logistic constraints need to be factored in for the physical delivery of oil. It might even lead to companies claiming force majeure clauses and violation of contracts.

With no demand for oil and the existing reserves at near capacity, no one wanted the physical delivery of oil to accumulate it and pay for the storage costs.

Speculators are an integral part of the commodities markets too. Speculators usually buy and sell contracts with no intention of accepting or offering the delivery. These participatory speculators need to unwind their positions on the contract expiry day to avoid taking the physical delivery of oil. Speculators were unwinding the future contracts to close their positions or rolling over their contracts before the expiry might have led to such a drastic fall in prices.

The delivery-based traders backing out on the contract due to a fall in oil demand can also be attributed to this fall. A combination of both categories of traders in play has brought havoc in the oil future markets.

Many speculators rolling over their contracts to June and future expiry dates pushed down the short-term prices even more. The future prices of oil are higher, thereby leading to contango in the market. The higher rates in the future also indicate the market expectations of resuming economic activity in the coming future as lockdowns are lifted. We can also expect the storage space to be created as existing reserves will be used up. Contango trades by market participants will be the norm in the coming days. These trades essentially translate to traders buying oil at lower prices now and storing them and releasing it in the market in the future when both demand and prices rise.

Global Impact

The WTI crude price fall also has raised concerns about the liquidity crisis looming over the banks in Texas. However, the Federal Reserve has promised to back up the banks to prevent another systemic failure. The fall in prices might even lead to a deflationary scenario as the price of oil dependent products would fall, which would then raise questions on the usage of substitute cleaner sources of energy.

Impact on India

SEBI and MCX are closely monitoring the negative oil prices. SEBI will be leading the way in dealing with negative rates. Taking in mind the system failures which might occur due to such sudden drops in prices and the drop-in prices in NYMEX Oil from which MCX derives its rates, MCX has now over nightly fixed the settlement price of the contract at Re 1 with further finalizations to be announced.

India has been piling up the strategic reserves in Mangalore, Vishakhapatnam, and Padur, near Udupi. The storing capacity has also been increased to take advantage of the lower oil prices. The fall in oil prices would lead to the fall in the oil expense of the nation and can be seen as an unforeseen relief to the government in its fight against the pandemic. The current account deficit may also reduce if the economic recovery is quick, and we are able to build up momentum with an increase in Indian exports.

Sources:

- https://www.mcxindia.com/products/energy/crude-oil

- https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html

- https://www.thehindu.com/business/explained-why-are-oil-prices-in-negative-terrain/article31394425.ece

- https://www.thehindubusinessline.com/markets/commodities/mcx-fixes-crude-oil-price-at-1-for-april-as-us-price-ends-at-37/article31393857.ece